Custody

Process automation system for traders

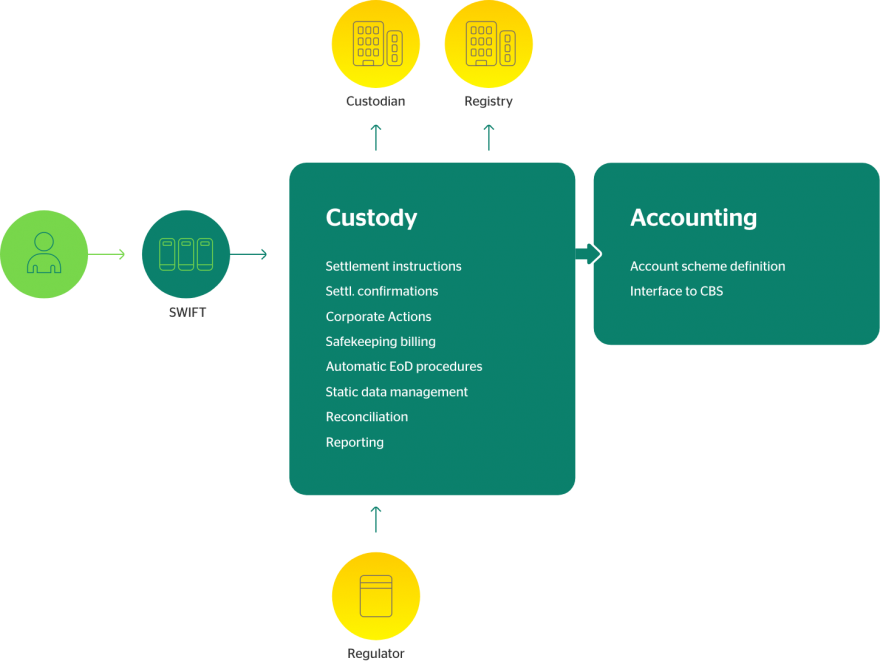

The system automates processes for bank and non-bank securities traders from receiving orders, through settlement of concluded transactions and their posting, to managing client positions.

How the system works

The system facilitates the execution of a wide range of client orders automatically and manually through a unified market access interface that uses communication standards such as FIX, SWIFT, etc. Market access may be direct, such as for Xetra system markets (CEESEG FIX, ETS/EnBS) or via international trading platforms such as Bloomberg (EMSX, EMSxNET) or via direct FIX connections.

We’ve cooperated with CTS TRADE IT since 2016. We primarily use the CTS system for custody services. I appreciate the reliability and flexibility of our cooperation, and the fact that CTS TRADE IT always strives to design the optimum solution to meet our needs.