Funds

Create the potential for growth

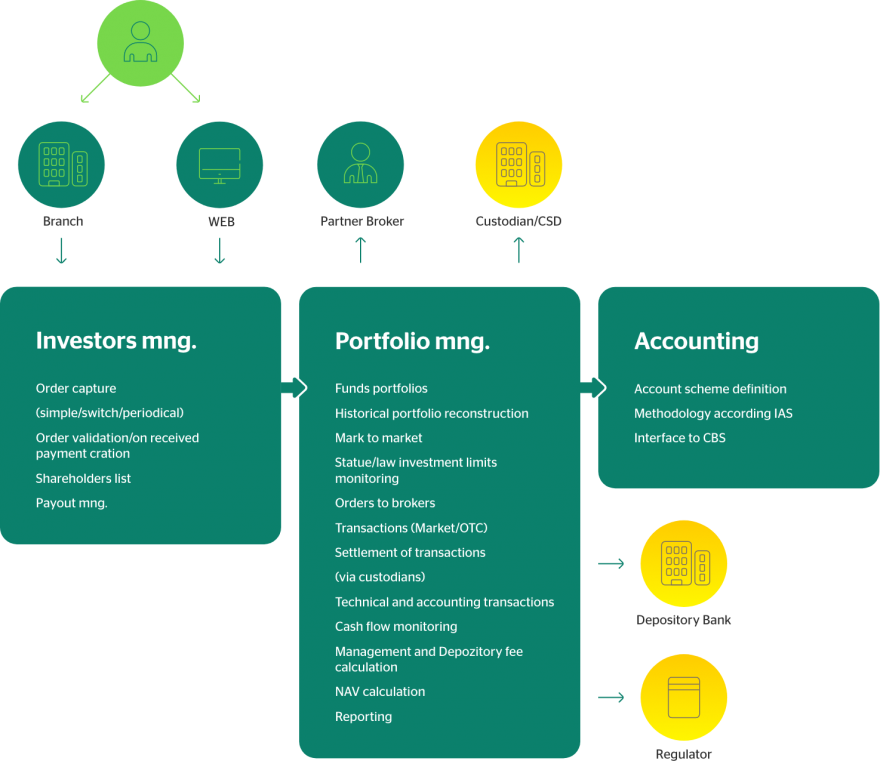

Comprehensive solution for the distribution of funds, their management and solutions for funds of pension companies in a modified version.

CTS Funds

Create the potential for growth

Manage an investment firm’s agenda in CTS and manage collective investment funds. Sell your investment firm’s active funds and third-party funds. CTS can even be used for pension insurance funds with modified settings.

Investment firms

Manage an investment firm’s agenda in CTS and manage collective investment funds. CTS can even be used for pension insurance funds with modified settings.

Shareholder administration contains the following agenda:

- acceptance of purchase orders in the form of invested amount, for sale by number of units

- simple or chained instructions (switch funds), regular investments

- generate or validate orders based on incoming payments

- controlling the redemption process

Banks

You can sell your investment firm's products via your branch network or third-party products using our platform. CTS allows you to conduct a complete agenda for communicating with fund issuers, aggregating and de-aggregating your orders, and managing fees. Reporting to clients and regulators are given. At the same time, the platform is able to evaluate client knowledge profiles, and appropriateness, in short, all the essentials under MiFID regulations.

We’ve collaborated with CTS TRADE IT since 2016. Over this time, the CTS system has become the core platform for trading investment products for the bank’s retail and private segment clients. In addition to the high reliability of the system itself, I appreciate the proactive and fair approach taken by our vendor, who completes individual deliveries on-time and at the necessary level of quality.